RIP Tills: ‘Grab and Go’ and the Future of Brick-and-Mortar Retail

The move towards contactless payment has been gaining momentum for years. In 2017, card transactions overtook cash payments for the first time – and since then, contactless payments have continued to increase in popularity.

According to Which?, ATMs are closing at a rate of 300 per month, and cash payments are expected to fall to as little as 10% of all UK transactions within the next 15 years.

However, a cashless society wouldn’t be good for everyone. Over eight million adults in the UK (17% of the population) rely on cash payments every day. People on lower incomes tend to find tangible money easier to manage, and the older generations often don’t have digital payment platforms set up on their devices.

But despite these very valid concerns about leaving great swathes of the population behind, the UK is quickly becoming a cashless nation. It’s an efficient inevitability that’s being widely embraced by banks, regulators and retailers alike.

The contactless conundrum

Moving to a completely cashless society may be a contentious subject, but when it comes to in-store retail experiences, today’s consumers are near-united. Modern shoppers have a growing appetite for speed and convenience – and a growing affinity for self-serve technology.

With self-scan devices and self-checkouts now commonplace, retailers are reaping the rewards of increased customer satisfaction and reduced staffing requirements, even at peak periods.

The benefits are too good to ignore, and forward-thinking retailers are looking towards the next big thing to drive efficiency: automated retail.

Automated retail – or ‘Just walk out’ shopping – provides a till-free, frictionless experience. Customers are monitored as they traverse the aisles, and weighted shelves identify which items are chosen as they shop. Then, when the customer leaves the store, the items are automatically debited from their preferred payment account and a receipt is sent to their phone. No scanning. No human interaction. No wait times. ‘Just walk out’ shopping provides ultimate convenience – for both the consumer and retailer.

But will automated retail become the norm across brick-and-mortar retail? And are UK stores ready to take the leap?

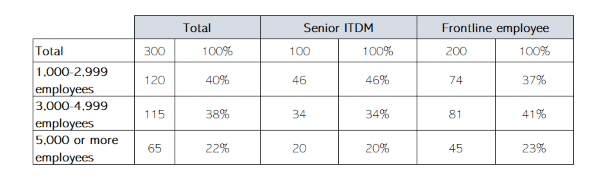

To find the answers to these questions, we conducted a large-scale survey into how UK retail workers view the future of shopping. We surveyed 100 senior IT decision makers (ITDMs) and 200 frontline workers to discover their predictions. Interestingly, there seems to be some disparity in the ranks. 30% of frontline employees don’t see till-free shopping becoming the norm. But just 3% of ITDMs (IT decision makers) feel the same.

To understand these conflicting views , let’s explore the pros and cons of automated retail – and showcase some examples of till-free shopping done right, and gone wrong.

Unbeatable experiences. Unbeatable prices.

In September 2021, Aldi opened its first Shop&Go store in Greenwich, London. Customers downloaded the Aldi app before entering and then went about their shopping as normal – the only difference from their usual experience came when they paid. Instead of joining the (notoriously long) checkout queues, customers just walked out the store and were automatically charged via their selected payment method.

Any customers wishing to buy alcohol, or other Challenge 25 products, were asked to use a facial age-estimation technology to authorise their purchase. The entire experience was simple, seamless and convenient.

This is successful retail automation in action. The technology itself isn’t overly remarkable – it just works well. Aldi are serving their popular products and discounted pricing in a new and innovative way – and shoppers are thrilled with the experience.

‘Cash’ still trumps convenience

Other retailers haven’t been so lucky.

Some shopping apps are too tricky for the everyday consumer to set up quickly. The problem might be a clunky user interface, a lack of sign-in options, or multiple-step verification. Whatever the issue, if customers can’t get onboard with the tech itself, the entire retail experience is going to suffer.

Take Sainsbury’s as an example. The grocer had to reintroduce tills into its first till-free store because customers struggled to scan items with the retailer's SmartShop Scan app. And even AmazonFresh – the pioneer of till-free technology – is struggling to get shoppers through the door.

With the ongoing cost-of-living crisis continuing to squeeze household budgets, customers are prioritising low prices over low wait-times. The ‘Just walk out’ experience simply isn’t compelling enough to compete with lower costs, so shoppers are opting for the aforementioned queues over AmazonFresh’s convenience.

While this isn’t ideal for AmazonFresh, it does present a potentially prosperous opportunity for discount retailers and general grocers. If stores can get their automated experience right, and continue to keep their prices low, they’ll welcome customers in droves.

So how can retailers make sure they have the right infrastructure in place to support till-free shopping? They need a reliable, high-bandwidth network.

A better network for a brighter future

It’s clear that checkouts are on the way out, and contactless, till-free shopping is here to stay. At TalkTalk Business, we provide retailers with the flexible, reliable network they need to manage large amounts of customer data.

You’ll have the speed and resilience you need to provide the seamless, self-serve shopping experience customers will soon come to expect in-store. And your network is designed around you, so you’ll have the flexible infrastructure you need to future-proof your business, too.

To learn more about the future of retail – and how retailers are embracing till-free technology across the UK – read our exclusive whitepaper: The Future of Retail: Automated or People-Powered?

About the research

In September 2022, we commissioned a survey by Vansorn Bourne of 300 senior IT decision-makers and frontline employees in business sizes ranging from 1,000-2,999 employees to those with 5,000 or more.